Epf Withdrawal for Education

You can choose to withdraw your savings from Account 2 to help finance your own children spouse andor parents education at approved institutions locally or abroad. Lock in period till the subscriber reaches 55 years of age.

Financing Your Studies Through Epf

Name Phone number City Purpose of loan.

. However to process the EPF withdrawal online your Universal Account Number UAN should be active. After 58 years of age or if unemployed for 60 days or longer. Repayment of home loan 6.

Next select the Claim. Invest in Mutual funds via BLACK APP 1200 Install Looking for a business loan. No interest rate applied.

Land purchase If you have been in service for 5 years you can withdraw up to 2 years of your monthly pay along with the Dearness Allowance to purchase land in your or your spouses name or jointly. 85 rate of interest is applicable to the EPF contribution for FY 2020-21. Lock in period till the subscriber reaches 60 years of age.

The latest PF withdrawal rules also allow an account holder to withdraw. 2021 Union Budget Update. With that in mind the EPF allows you to withdraw your EPF savings to partially pay for.

Age Limit for withdrawal. Tertiary education is exceptionally expensive these days and while PTPTN has done a good job of assisting those who need help with paying for tuition fees it may be difficult to immediately repay your study loan in the years after you start working. You cant withdraw PF balance from your current job.

Upon successfully logging in first verify if your KYC details are under the Manage tab. EPF withdrawal form will be displayed on the screen. PF Form 2 is a nomination and declaration form under the Employees Pension and PF schemes paragraph 18 of Employees Pension Scheme 1995 and the paragraph 33 and 61 1 of Employees Provident Fund Scheme 1952.

In case the PF contribution of the employees was deducted but the employer did not deposit it to the EPF contribution then the amount will not be allowed as a deduction for the employer. Reduced Processing Time- With online claims the amount will be processed and credited into your bank account within 15-20 days of the application. Quality education is the key to a stable career that will result in a comfortable life for you and your family.

Form 15G Download In Word Format. In March 2020 the government had announced that an individual can withdraw a certain sum from their Employees Provident Fund EPF account if faced with financial stress due to coronavirus and the pandemic-induced lockdowns. PF withdrawal conditions to keep in mind.

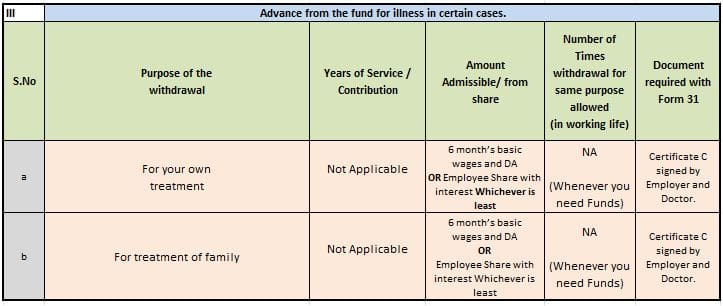

Hassle-free Withdrawal-The online process of EPF withdrawal claim saves you from the hassle of visiting the PF office in person and standing in long queues. EPF Form 31 is utilised to file a claim for partial withdrawal of funds from EPF or Employees Provident Fund. Over a year later in May 2021 the labour ministry announced that EPF members can avail a second non-refundable advance from their.

The following steps will help you to raise the withdrawal claim online. PF withdrawal for a particular purpose. Two pages namely Part I Part II will be there where you will have to fill out the details.

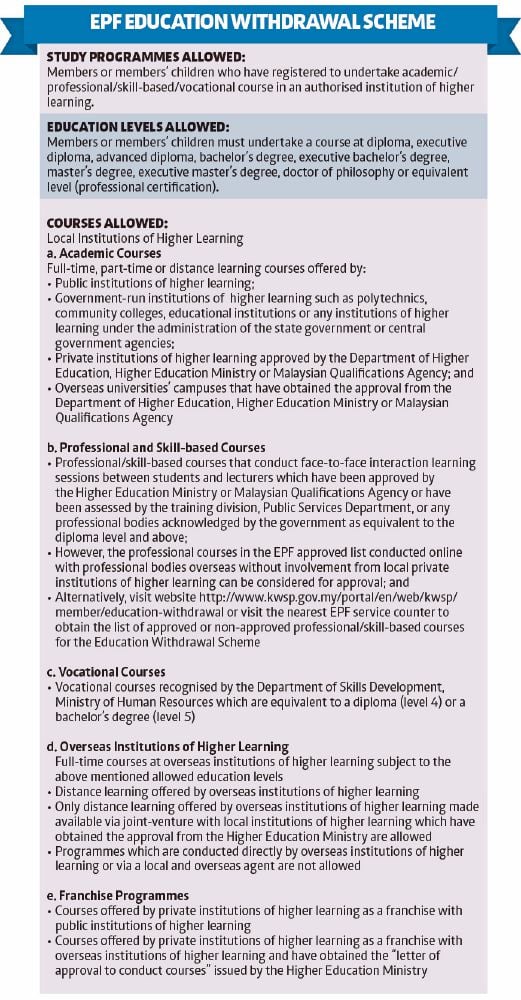

Also withdrawals before 58 years will not include the employers contribution and. EPF Withdrawal for Education Including PTPTN. Explained below are both of them-Online EPF Withdrawal Process.

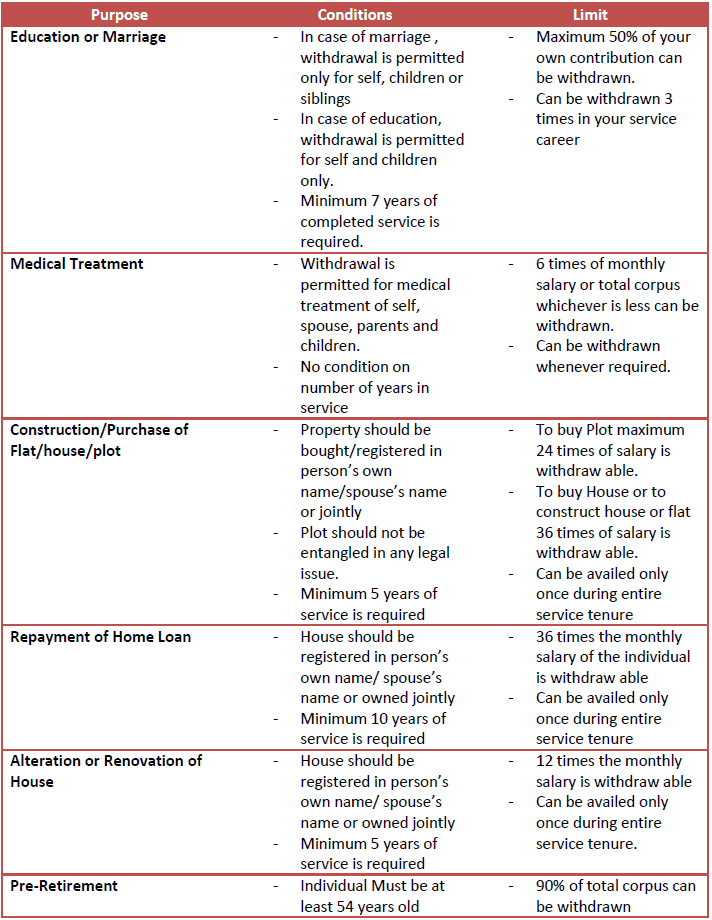

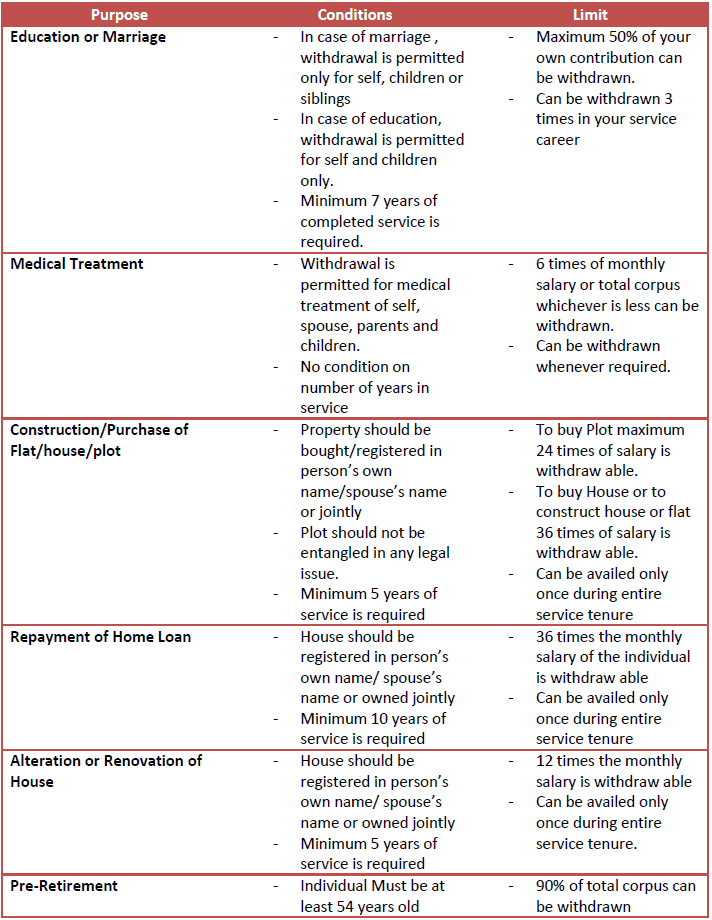

Login using your UAN and password on the Official EPFO member portal. Education If you have been in service for 7 years you can withdraw up to half of the employees quota of EPF fund for your education. Withdrawals allowed after completing 15 years.

Check EPFO portal for Employee Provident Fund Withdrawal Claim Status Transfer Balance. Pension is received after 58 years of age. The funds will be transferable after contributing a minimum of 7 years towards the EPF account.

Before you move on to the process to withdraw EPF you must ensure that your UAN is activated and is linked with your KYC Aadhaar and PAN. Below the EPF withdrawal form the user will be able to Upload Form 15G. A few years before retirement.

PF account holders can withdraw up to 50 of the total employees contribution to EPF to pay for their higher education or to bear the education cost of their children after class 10. 10 years of minimum service and 50 years of age for early pension. Higher education of the employee or hisher children.

Interest received on EPF is exempted. To withdraw 100 amount the subscriber must be 58 years. However to avail the online facility the EPFO.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. 58 years of age for regular pension. In this particular kind of provident fund employees are required to contribute a.

PF or EPF withdrawal can be done either by submission of a physical application for withdrawal or by an online application using UAN. Construction of house or land purchase 4. The provision to withdraw money from EPF accounts was first announced in March 2020 under the Pradhan Mantri Garib Kalyan Yojana PMGKY According to the withdrawal rules EPFO members can take non-refundable withdrawals of up to three months basic earnings and dearness allowance or 75 percent of the EPF account balance whichever is smaller.

PF withdrawals within 5 years of opening an account are taxable 2. You can follow either the online process or the offline process to withdraw your EPF. Click on it and From 15G will be downloaded to your device.

EPF or Employees Provident Fund is a government-backed savings option that can facilitate salaried individuals to build a significant corpus to cover their financial needs post-retirement. PF Withdrawal Rules 2022. How to Withdraw EPF.

Required Information to Fill PF Form 2. To pay for marriage. Online EPF Withdrawal Using EPFOs online facility members can apply for PF final settlement pension withdrawal benefit and PF part withdrawal.

EPF advance for higher education of sondaughter EPFO allows withdrawal of 50 per cent of an employees share with interest for post-matriculation studies of hisher children.

Epf Withdrawal Rules When And For What You May Withdraw Your Epf

Epf Partial Withdrawal Or Advance Process Form How Much

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Epf Partial Withdrawals Advances Options Guidelines 2020 21

0 Response to "Epf Withdrawal for Education"

Post a Comment